Georgia Counties With School Tax Exemption . It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. Property tax rates could drop in some georgia school districts under a house plan. The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. It would let districts with low property wealth. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000. Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption.

from mungfali.com

It would let districts with low property wealth. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. Property tax rates could drop in some georgia school districts under a house plan. Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000.

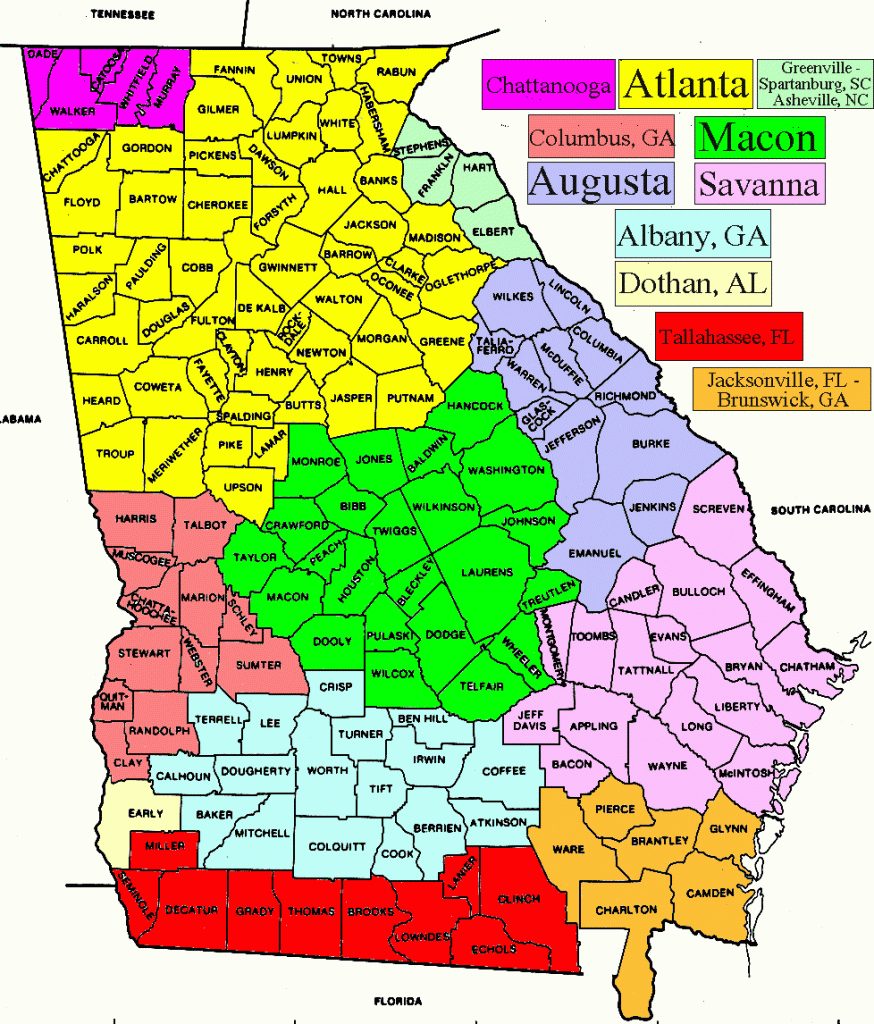

Counties Map Printable

Georgia Counties With School Tax Exemption The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. Property tax rates could drop in some georgia school districts under a house plan. It would let districts with low property wealth. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000. Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption.

From www.countyforms.com

Property Tax Appeal Form Fulton County Ga Georgia Counties With School Tax Exemption The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. A 100 percent exemption for school tax is available for those age 65 or older and with. Georgia Counties With School Tax Exemption.

From www.exemptform.com

Ga Out Of State Tax Exempt Form Georgia Counties With School Tax Exemption Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. Property tax rates could drop in some georgia school districts under a house plan. It would let districts. Georgia Counties With School Tax Exemption.

From fillable-ohio-tax-exempt-form.pdffiller.com

Example Of Tax Exempt Certificate Fill Online, Printable, Fillable Georgia Counties With School Tax Exemption Property tax rates could drop in some georgia school districts under a house plan. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income. Georgia Counties With School Tax Exemption.

From www.mapsofindia.com

Map Map of (GA) State With County Georgia Counties With School Tax Exemption Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. Property tax rates could drop in some georgia school districts under a house plan. It would let districts with low property. Georgia Counties With School Tax Exemption.

From mashaqjulina.pages.dev

2024 Estate Tax Exemption Irs Andra Blanche Georgia Counties With School Tax Exemption Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. Property tax rates could drop in some georgia school districts under a house plan.. Georgia Counties With School Tax Exemption.

From www.exemptform.com

Orange County Homeowners Exemption Form Georgia Counties With School Tax Exemption The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on. Georgia Counties With School Tax Exemption.

From www.exemptform.com

FREE 8 Sample Tax Exemption Forms In PDF MS Word Georgia Counties With School Tax Exemption Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000. Property tax rates could drop in some georgia school districts under a house plan. It would let. Georgia Counties With School Tax Exemption.

From beatrixwpoppy.pages.dev

Map Of Counties 2024 Kimmi Merline Georgia Counties With School Tax Exemption Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. It would let districts with low property wealth. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000. Property tax rates could drop. Georgia Counties With School Tax Exemption.

From citiesandtownsmap.blogspot.com

Map Of School Districts Cities And Towns Map Georgia Counties With School Tax Exemption It would let districts with low property wealth. Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. Property tax rates could drop in some georgia school districts under a house plan. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable. Georgia Counties With School Tax Exemption.

From www.exemptform.com

Disability Car Tax Exemption Form Georgia Counties With School Tax Exemption The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. A 100 percent exemption for school tax is available for those age 65 or older. Georgia Counties With School Tax Exemption.

From www.exemptform.com

Dekalb County Certificate Of Compliance Or Exemption Form Georgia Counties With School Tax Exemption Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. Senior homeowners in fulton county who live outside atlanta city limits can apply for. Georgia Counties With School Tax Exemption.

From www.amazon.ca

County Map (36" W x 36" H) Amazon.ca Office Products Georgia Counties With School Tax Exemption It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. A 100 percent exemption for school tax is available for those age 65 or. Georgia Counties With School Tax Exemption.

From www.counton2.com

The amount of students earning religious exemptions for vaccinations is Georgia Counties With School Tax Exemption Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income. Georgia Counties With School Tax Exemption.

From epd.georgia.gov

Counties and the Assigned ASOS Station for Each County Georgia Counties With School Tax Exemption Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. Property tax rates could drop in some georgia school districts under a house plan. It would let districts with low. Georgia Counties With School Tax Exemption.

From www.georgia.usta.com

District Map CTA Map USTA Georgia Counties With School Tax Exemption It would let districts with low property wealth. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. It exempts $54,000 of assessed value from fulton county school system taxes. Georgia Counties With School Tax Exemption.

From materialmcgheealister.z21.web.core.windows.net

Printable County Map Georgia Counties With School Tax Exemption Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. Reduces your taxable value by your standard homestead exemption plus $2,000 plus $30,000 on the portion to which school taxes are applied. It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an. Georgia Counties With School Tax Exemption.

From mapofutahimages.pages.dev

State Map With Counties And Cities Map Of Canada Georgia Counties With School Tax Exemption Senior homeowners in fulton county who live outside atlanta city limits can apply for a $10,000 homestead exemption. A 100 percent exemption for school tax is available for those age 65 or older and with a georgia taxable income of less than $15,000. The georgia school tax exemption program could excuse you from paying from the school tax portion of. Georgia Counties With School Tax Exemption.

From www.signnow.com

St 5 20162024 Form Fill Out and Sign Printable PDF Template Georgia Counties With School Tax Exemption It exempts $54,000 of assessed value from fulton county school system taxes for those age 65 and above, with an income limit of $30,000,. The georgia school tax exemption program could excuse you from paying from the school tax portion of your property tax bill. Senior homeowners in fulton county who live outside atlanta city limits can apply for a. Georgia Counties With School Tax Exemption.